Listen to Your Investors: Climate Is the Top ESG Factor, Finds US SIF

The latest US SIF study finds that climate change/carbon emissions is the top ESG factor among US sustainable investors.

Disclosure: Information in this article is observational in nature and is not meant to be taken as financial advice.

Our parent company, JournoContent LLC, has clients involved in sustainability-related areas, among others. The owner of Carbon Neutral Copy, Jacob (Jake) Safane, has sustainability-related investments, including, but not limited to, in ESG-related funds.

As such, conflicts of interest related to these and other investments/business relationships, even if unintended, may exist at times. Please email info@carbonneutralcopy.com if you'd like further clarification on any issues

As the planet heats up, investors are putting pressure on companies to adopt more sustainable business practices. In particular, many investors are turning to environmental, social and governance (ESG) strategies.

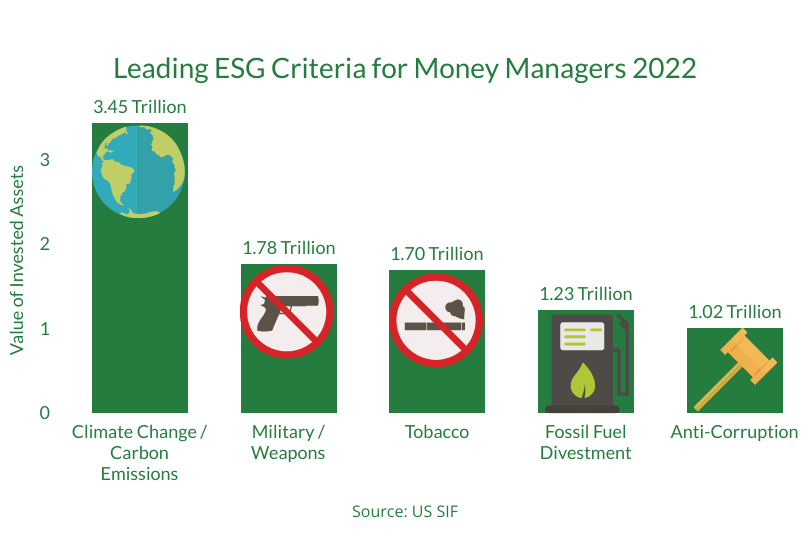

While many subtopics fall under the ESG umbrella, climate change/carbon emissions is the top ESG issue in the US, weighted based on the value of assets focused on this area among asset managers and institutional asset owners, according to the latest US SIF survey.

“The discourse on climate is not new but has risen to the top of the ESG priorities because it can impact all industries across all geographies and is an earth system-wide crisis. This will continue to be a focal point for investors as they track progress on corporate decarbonization,” says Dr. Bruce Kahn, lead portfolio manager of the Shelton Sustainable Equity Fund at Shelton Capital Management. Kahn served on the board of directors for US SIF from 2017-2018.

Other environmental factors, like the use of sustainable natural resources/agriculture and fossil fuel divestment, are also popular ESG integration areas. Social and governance issues, like avoiding military/weapons companies or enterprises that do business in high conflict-risk countries, also attract significant assets.

Keep in mind that investors can incorporate different ESG factors within the same asset pool, thus there's a mismatch between total sustainable investing assets and ESG criteria weighted by assets. There also can be some overlap amongst categories, but US SIF tries to separate them as much as possible, which led to climate change/carbon emissions becoming the top ESG metric.

“Carbon emissions aren’t the only thing that affect climate change, but they are a quantifiable contributor to climate change, which makes it easier to address climate change through addressing carbon emissions — something that businesses have control over,” says Daniel Naim, CEO and founder of Fennel, a retail investing app with a focus on ESG data.

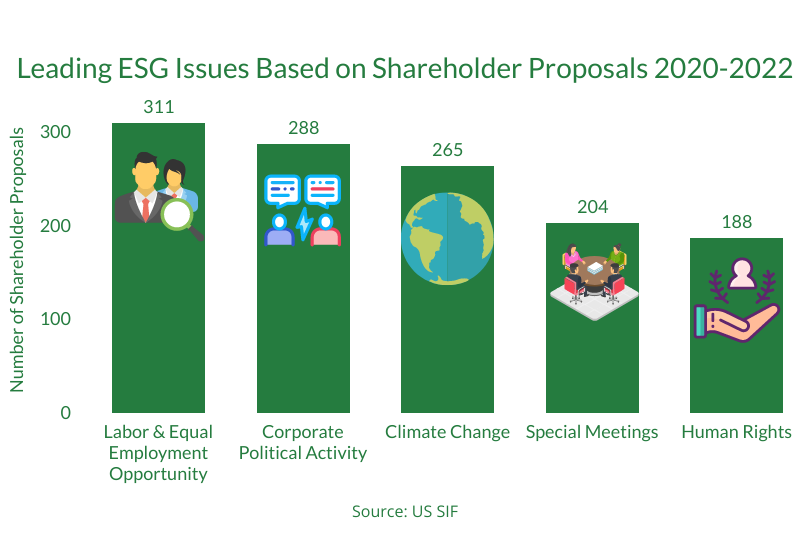

In addition to looking at ESG investing based on allocated assets, US SIF analyzed shareholder resolutions at publicly traded companies to get a better sense of the overall sustainable investing landscape.

For the period of 2020-2022, climate change ranked third based on the number of shareholder proposals filed. Labor & equal employment opportunity came in first, followed by corporate political activity.

Naim says that the shareholder proposals data indicates the importance of climate change but also that companies need to address social and governance issues that are often more directly felt within a corporation.

“Maybe this shift in priorities has to do with what people are paying attention to now — things like the #MeToo movement or racial justice initiatives following the murder of George Floyd, or oil companies lobbying politicians to loosen environmental restrictions. Investors may see companies being called out for these practices and they want to make sure the companies in their portfolios aren’t making the same mistakes,” notes Naim.

“Regardless of which category has more proposals than the others, the fact that all three categories are common shows that investors do care about these things and expect companies to do better,” he adds.

A Call to Action

The US SIF findings underscore how investors are putting their dollars and their voices to work to tackle both societal and corporate challenges. Companies can (and arguably should) recognize the emphasis on responsible investing — particularly areas like climate change/carbon emissions — as an opportunity to attract investors while improving their own operations.

“The Intergovernmental Panel on Climate Change (IPCC) has released increasingly urgent reports regarding the state of climate change and the need to reduce GHG emissions. Investors have taken notice and responded with calls to action and commitments,” says Farzana Hoque, acting director of research at US SIF. “Additionally, there are an increasing number of resources and initiatives to help investors reduce the GHG emissions footprint of their portfolios.”

That ease could spur more investment dollars going toward tackling climate change and other ESG factors. In turn, that can put more pressure on companies to adapt. That could mean improving ESG reporting/ESG disclosure to attract capital, as well as actually improving operations to better account for ESG risk factors.

The good news for companies is that it might not be too late to appeal to investors on this issue, as it will likely remain among the top ESG factors in the coming years.

“It’s hard to predict what the findings will be in two years given how dramatically things can change, but I expect it’d remain as a top issue if not the top issue,” says Hoque.

And while ESG funds often invest in publicly traded companies, there are also plenty of environmentally-oriented investors allocating to private markets. So, startups, for example, can still benefit from ESG consideration.

“Private companies are subject to the same challenges as public, as they seek to access capital from funds and institutions who are also committed down this road,” says Kahn.

In addition to attracting institutional investor capital by aligning with ESG strategies, companies can pay attention to things like shareholder resolutions to better understand stakeholder priorities. Even if private companies don't face the same type of direct engagement, they can get signals from public market ESG practices.

“Investors want to help companies succeed," says Naim.

The growth of retail investors also means that a company's investor base is starting to look more like its customer base, adds Naim.

“Want to know what your customers really think? Look at your retail investors," he says.

A Note on Methodology

In all, US SIF identified $8.4 trillion in sustainable investment assets, accounting for nearly 13% of all US assets under professional management.

This number, however, is down significantly from previous US SIF studies due to meaningful methodology changes designed to weed out issues like inaccurately labeled funds. The organization also notes that “multiple money managers reported a modest to steep decline in ESG assets under management, which the US SIF Foundation believes is a reaction to the SEC's release of the fund disclosure proposal.”

That said, other indicators show that sustainable investing is growing, as is the number of companies responding to ESG concerns. For example, PwC projects asset managers globally will nearly double ESG assets under management from 2021 to 2026. And as Kahn points out, MSCI data shows a growing number of companies are setting net-zero targets (46% of companies within the MSCI ACWI IMI index, as of 8/31/22).